After getting notice / intimation under various sections of Income Tax Act 1961, we have to submit revised return with rectification of errors mentioned in intimation.

Why are we getting these notices / intimations? Because of mistakes made by us in the original filing of Income Tax Return (Read:How to file your IT return online), such as giving the total salary amount instead of taxable income or missing a home loan monthly payments or missing other income, you have a chance to rectify it by filing Revised I-T Return and to avoid the penalty from income tax authorities, we have to submit this revised return before the end of 1 year from the assessment year-end or before your filings are assessed by the I-T department, with supporting documents for tax mismatch.

Why are we getting these notices / intimations? Because of mistakes made by us in the original filing of Income Tax Return (Read:How to file your IT return online), such as giving the total salary amount instead of taxable income or missing a home loan monthly payments or missing other income, you have a chance to rectify it by filing Revised I-T Return and to avoid the penalty from income tax authorities, we have to submit this revised return before the end of 1 year from the assessment year-end or before your filings are assessed by the I-T department, with supporting documents for tax mismatch.

But our chance to file revised return is conditioned with

- Original return should be filed on time, i.e. before July 31 of a given year.

- IT department has not completed assessment of your I-T Return.

- The mistake in the original return is a genuine one.

To file your revised return, you don't have to reach any professional CA or adviser. you can file it on your own at income department online facility. off course, you can file it online, when you file your original return online. That means if your original return in physical one, you have to submit your revised return physically.

To start your e-filing of revised return, login into the www.incometaxindiaefiling.com

Before login into the website, just keep the original return copy, intimation copy and supporting documents for tax mismatch.

After login into the website, Click on "e-file" and follow the instructions provide in my previous article to file your revised return. Because most of the procedure is same as original return e-filing.

Once you reach the e-filing page, you have to give the following details in "PART A General Infomation"

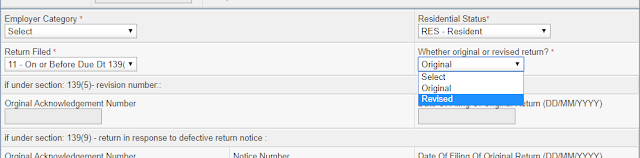

Under ‘Filing Status’ in the second section, choose the employer category and return-related information.

In column A21, you need to choose ’17 - revised return - 139(5)’ because you are filing revised return. Make sure the box below it is set to ‘Revised’.

In column A24, fill in the acknowledgement number of original ITR and the date when the return was first filed.

Then you can rectify your previous errors what you made while filing the original return. Just fill the correct information in income details or tax details screen and "taxes paid and verification" screen.

Please check one more time, before your final submission.

I hope that it is useful for you. Please share your experiences or queries in comments below

No comments:

Post a Comment